In the comprehensive blog post titled ‘How to Get Gap Insurance’, readers are guided through the essential aspects of gap insurance, illustrating its importance for car owners. The article outlines ‘How to’ secure gap insurance in three straightforward steps while emphasizing the need to evaluate different options available in the market. It addresses common misconceptions about gap insurance and explores the associated costs, ensuring readers are well-informed about the financial implications. Additionally, the post highlights the significant benefits of purchasing gap insurance, along with practical tips for selecting reliable providers. Key takeaways reinforce the insights gained about gap insurance, empowering readers to make informed decisions regarding their vehicle coverage.

Understanding The Importance Of Gap Insurance

Contents

- 1 Understanding The Importance Of Gap Insurance

- 2 How To Get Gap Insurance In Three Steps

- 3 Evaluating Different Gap Insurance Options

- 4 Common Misconceptions About Gap Insurance

- 5 Exploring The Costs Of Gap Insurance

- 6 Benefits Of Purchasing Gap Insurance

- 7 Tips For Selecting Gap Insurance Providers

- 8 Key Takeaways From Gap Insurance Insights

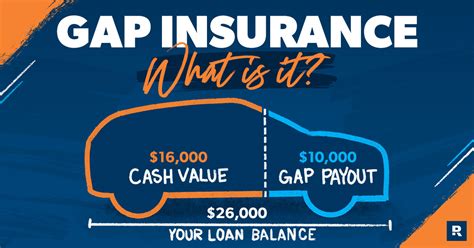

Gap insurance serves as a critical safety net for vehicle owners, ensuring that they are financially protected in the event of an accident that results in a total loss of their car. The primary function of gap insurance is to cover the difference between what an insurance company will pay for a totaled vehicle and the amount owed on the car loan or lease. This is particularly essential when a vehicle depreciates quickly, as the outstanding loan can often surpass the car’s current market value.

When considering how to secure gap insurance, it’s vital to recognize that not all drivers will need this addition to their policy. Factors such as the age of the vehicle, loan amount, and how much the car is expected to depreciate should be analyzed. Moreover, gap insurance is commonly recommended for new car buyers and those who have a long-term loan with a low down payment, as these scenarios carry a higher risk of being upside down on a car loan.

| Factor | Importance | Consideration |

|---|---|---|

| Vehicle Age | Newer vehicles depreciate faster | More likely to benefit from gap insurance |

| Loan Amount | Higher loans increase risk | May require additional coverage |

| Down Payment | Low down payments add to risk | Consider likelihood of being upside down |

| Insurance Coverage | Main policy limitations | Gap insurance provides necessary coverage |

Choosing whether to obtain gap insurance relies heavily on an individual’s financial situation and risk tolerance. Understanding your specific circumstances will provide clarity on whether this type of insurance is necessary. Thus, doing diligent research and comparing policies can also help in making an informed decision. Options can vary significantly in terms of cost and coverage, so evaluating these beforehand is essential.

Key Reasons To Consider Gap Insurance

- Protects against financial loss in case of total loss

- Covers the difference between market value and loan balance

- Recommended for new cars and leased vehicles

- Mitigates the effects of rapid depreciation

- Provides peace of mind during ownership

- May be included in financing options

- Can be a smart investment for financially cautious drivers

Ultimately, understanding the importance of gap insurance is integral for vehicle owners, especially those with substantial financing on their cars. It acts as a protective measure that can alleviate potential financial burdens created by the unfortunate situation of a vehicle totaling, thereby providing significant value to individuals who qualify for it.

How To Get Gap Insurance In Three Steps

Obtaining gap insurance is a straightforward process that can provide significant peace of mind for those who have financed or leased a vehicle. How to get gap insurance involves understanding your needs, comparing options, and completing the purchase process. This form of insurance can help cover the difference between what you owe on your car and its current market value in the event of a total loss, making it a wise investment for many car owners.

Before starting your journey to acquire gap insurance, it’s essential to gather information about your vehicle and financing situation. Knowing the current balance on your auto loan, the vehicle’s market value, and any existing insurance policies will streamline the process. This will allow you to make more informed decisions that align with your financial goals.

| Step | Description | Tips |

|---|---|---|

| 1 | Assess your financing needs | Review your auto loan agreement |

| 2 | Research your gap insurance options | Gather quotes from different providers |

| 3 | Compare coverage and costs | Look for the most favorable premiums and terms |

| 4 | Purchase the gap insurance | Ensure all terms are clear before signing |

Following your research, you can then proceed with the actual purchase of gap insurance. It’s advisable to carefully read through the terms and conditions to understand what is covered and any limitations. Furthermore, confirm that the provider is reputable and has positive reviews from existing clients. Perform due diligence to ensure that you are getting the best value for your money.

Steps To Acquire Gap Insurance

- Determine if gap insurance suits your needs based on your vehicle financing.

- Collect necessary information about your vehicle and loan balance.

- Research various gap insurance options from different providers.

- Request and compare multiple quotes to find the best deal.

- Read the policy details, ensuring all your concerns are addressed.

- Complete the transaction and keep copies of your insurance documents.

- Review your gap insurance coverage regularly to ensure it remains relevant.

Ultimately, acquiring gap insurance is about protecting your financial investment in your vehicle while navigating the uncertainties of car ownership.

Evaluating Different Gap Insurance Options

When considering gap insurance, it’s essential to evaluate various options to find the plan that best meets your needs. This evaluation process involves scrutinizing the coverage offerings, assessing costs, and examining provider reliability. Understanding these factors will ensure that your investment in gap insurance is both valuable and practical. To help streamline your decision-making process, let’s delve into key areas to focus on when selecting the ideal gap insurance plan.

One crucial aspect to evaluate is the affordability of different gap insurance options. Prices can vary significantly based on various factors, including your vehicle’s value, loan details, and the insurance provider. By comparing several quotes and understanding what is included in each plan, you can identify the most cost-effective solution. It is also prudent to look into potential discounts that may be applicable, such as those for multiple policies or safe driving records.

| Provider | Coverage Amount | Cost Per Month |

|---|---|---|

| Provider A | Up to $50,000 | $15 |

| Provider B | Up to $40,000 | $12 |

| Provider C | Up to $60,000 | $18 |

| Provider D | Up to $30,000 | $10 |

Another essential factor in your evaluation is the coverage options available through various providers. This involves analyzing not only the basic coverage but also any extras that may be included or offered as add-ons. For instance, some plans may cover fees such as sales tax or registration fees that would only add to your financial burden in the event of a total loss. It’s crucial to compare these coverage features to ensure you are adequately protected.

Factors To Compare

- Monthly premium costs

- Max coverage limits available

- Inclusions/exclusions of the policy

- Potential discounts offered

- Customer service reputation

- Claims process efficiency

Finally, evaluating provider reliability is fundamental to making an informed decision. Researching customer reviews, ratings, and the experience of others can give you insight into how well a provider handles claims and customer service. A reliable provider should have a transparent claims process and a history of positive customer interactions. Always ensure that the provider you choose is reputable and has a proven track record in the insurance industry.

Cost Analysis

Understanding the cost dynamics of gap insurance is pivotal in making a sound financial decision. Comparing different plans based on their coverage and monthly fees helps you to identify the best value for your unique situation. In many scenarios, opting for a slightly more expensive plan could save you significant sums in the event of a total loss, making cost analysis an indispensable part of your evaluation.

Coverage Options

Coverage options play a vital role in ensuring that you choose a policy tailored to your needs. By thoroughly examining what each gap insurance plan covers, you can identify which features will most effectively protect you financially in the case of vehicle loss. Be diligent in understanding the nuances of each coverage option before making your final decision.

Provider Reliability

Provider reliability is the cornerstone of any insurance decision, especially with gap insurance policies. You want to ensure that the provider you choose is able to deliver on promises made in their policy. This requires careful research and due diligence to verify that your chosen provider has the necessary credentials and a solid reputation for standing behind their coverage.

Common Misconceptions About Gap Insurance

Understanding how to effectively utilize gap insurance is crucial for many car owners. However, misconceptions often cloud the decision-making process. Some individuals believe that gap insurance is merely an unnecessary expense, which can deter them from making an informed choice. This section aims to clarify these prevalent misconceptions and provide you with accurate information.

Many people think that gap insurance covers everything related to their vehicle. This is a misunderstanding, as gap insurance is specifically designed to cover the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease in the event of a total loss. Thus, it is vitally important to understand that while gap insurance minimizes financial risk, it does not replace your standard auto insurance coverage.

| Misconception | Reality | Impact |

|---|---|---|

| Gap Insurance is Not Necessary | It provides financial security during an accident. | Potential high out-of-pocket expenses. |

| Gap Insurance is Only for New Cars | It benefits anyone with an auto loan or lease. | Missed opportunities for savings. |

| Gap Insurance is Expensive | It often costs less than $20/month. | Affordable peace of mind. |

| Collision Insurance is the Same | They serve different purposes and scopes. | Inadequate coverage may lead to financial loss. |

Another common myth is that gap insurance automatically comes with your auto insurance policy. In reality, gap insurance is an optional add-on that must be separately purchased. Thus, it’s essential to check with your insurer to determine the specifics regarding availability and cost before making any assumptions.

Debunked Myths

- Gap insurance covers all car-related costs.

- It’s only necessary for new or expensive cars.

- It automatically comes with auto insurance policies.

- Gap insurance and collision insurance are the same.

- Gap insurance is too costly.

- It is unnecessary if you have a large down payment.

- All gap insurance policies are identical; they vary by provider.

In summary, understanding the truths behind these misconceptions will empower you as a car owner to make informed decisions when it comes to how to secure gap insurance. By demystifying these myths, you can assess the necessity and benefits of having gap insurance in your auto insurance portfolio, potentially saving yourself a significant financial headache in the future.

Exploring The Costs Of Gap Insurance

Understanding the costs associated with gap insurance is crucial for making an informed decision. How to approach the expense of gap insurance can significantly impact your overall financial health, especially if your vehicle is financed. Gap insurance is designed to cover the difference between the amount you owe on your vehicle and its actual cash value in the event of a total loss. This means that the premiums you pay can vary widely based on several factors, including your location, the type of vehicle, and the coverage limits you choose.

One of the primary considerations when assessing gap insurance costs is the range of premiums available. Different providers offer varying coverage plans, and thus, pricing can differ significantly. Additionally, factors such as the age of the vehicle, financial history, and even the insurance provider’s claim rate can contribute to the overall cost. Understanding these factors will help you navigate through the multitude of options available and select the best policy for your needs.

| Cost Factors | Impact on Pricing | Typical Range |

|---|---|---|

| Vehicle Age | Older vehicles may have lower premiums | $300 – $600 per year |

| Loan Amount | Higher loans can result in higher premiums | $300 – $700 per year |

| Provider Reputation | Reputable providers may charge more | $350 – $750 per year |

| Location | Premiums can vary by state | $250 – $700 per year |

Typical Cost Ranges

- Basic coverage: $20 to $40 per month

- Comprehensive coverage: $30 to $70 per month

- Loan-to-value ratio: impacts cost significantly

- Age and model of vehicle can affect rates

- Provider discounts for bundling with other policies

When contemplating the purchase of gap insurance, it’s vital to consider the potential benefits relative to the costs involved. Comparing quotes from several insurers can lead to substantial savings and a policy that aligns with your financial situation. Always read the terms and conditions carefully to avoid unexpected costs in the future, ensuring that your investment in gap insurance is both wise and economical.

Benefits Of Purchasing Gap Insurance

Purchasing gap insurance is an important decision for individuals who want to protect their financial investment in a vehicle. When you buy a new car or lease one, the value depreciates rapidly, often leaving you with a significant gap between what you owe and what your car is worth in case of an accident or theft. How to leverage gap insurance can ultimately save you from unexpected financial distress.

One of the primary benefits is the peace of mind it provides. Knowing that you are insured against the financial liabilities that come from a total loss or theft allows you to enjoy your vehicle without constant worry. Below is a table summarizing the financial implications of not having gap insurance compared to having it:

| Scenario | With Gap Insurance | Without Gap Insurance |

|---|---|---|

| Car Value at Loss | $20,000 | $20,000 |

| Remaining Loan Balance | $15,000 | $15,000 |

| Insurance Payout | $20,000 | $12,000 |

| Out-of-Pocket Cost | $0 | $3,000 |

In addition to providing coverage for potential losses, gap insurance can also enhance your overall financial planning strategy. For those who regularly engage with financial advisors or are keen on maintaining a healthy financial portfolio, this insurance acts as a safety net. Here are key advantages of purchasing gap insurance:

- Protects against depreciation of vehicle value.

- Ensures peace of mind while driving.

- Avoids costly out-of-pocket expenses.

- Helps in maintaining a good credit score.

- Can be added to existing insurance policies.

- Supports financial stability during troublesome times.

By understanding the specific advantages that gap insurance provides, consumers can ensure they choose the best product for their needs. Another critical aspect to consider is the affordability of gap insurance premiums. They are generally low compared to the potential financial loss incurred without coverage. As a result, investing in gap insurance proves to be a wise decision for car owners, especially those holding substantial loans.

Tips For Selecting Gap Insurance Providers

Choosing the right gap insurance provider is crucial to ensuring you are adequately covered in the event of a total loss of your vehicle. When assessing various providers, it is essential to conduct thorough research to find a reputable company that meets your specific needs. Look for providers that not only offer competitive rates but also have a strong track record of customer service and claims handling. Remember to check online reviews and customer testimonials as these can give you insights into the experiences of other policyholders.

Another important aspect to consider is the policy flexibility offered by different providers. Gap insurance policies can vary significantly in terms of coverage and exclusions. Make sure you understand the terms of the policy being offered. Some providers may have more comprehensive options or additional benefits, such as coverage for new cars or additional personal property. Always read the fine print and get clarification on any points that seem unclear before making your decision.

| Provider Name | Coverage Options | Customer Rating |

|---|---|---|

| Provider A | Standard & Comprehensive | 4.5/5 |

| Provider B | New Car & Used Car | 4.0/5 |

| Provider C | Standard with Extra Benefits | 3.8/5 |

| Provider D | Customizable Options | 4.2/5 |

To simplify the selection of gap insurance providers, you may want to follow a clear and concise process. Below are some key steps you should take to ensure a smooth experience when choosing a provider:

Selection Process Steps

- Research various gap insurance providers in your area.

- Compare coverage options and exclusions offered by each provider.

- Check customer reviews and ratings for feedback on claims processes.

- Evaluate the affordability of premiums against the coverage provided.

- Review the terms and conditions carefully.

- Ask for quotes and ensure you understand all costs involved.

- Consult with a financial advisor if needed to ensure the policy meets your needs.

Ultimately, selecting the right gap insurance provider involves balancing cost, coverage, and customer service. By conducting thorough research and comparing different options, you will be well-equipped to make an informed decision that protects your financial interests in case of an unfortunate event. Remember to take your time and consult professional advice if necessary, as this can make a significant difference in your experience and satisfaction with your gap insurance.

Key Takeaways From Gap Insurance Insights

Understanding how to get gap insurance is crucial for protecting your investment in a vehicle, especially if you’re financing or leasing. How to navigate the options available can be overwhelming, but it’s important to focus on how gap insurance works and when it might be necessary. By grasping the ins and outs, you can ensure you make informed decisions that align with your financial situation.

One effective approach is to evaluate your needs carefully before purchasing gap insurance. You should assess factors such as the value of your vehicle, any lease agreements, and your personal finances. The right gap insurance can save you thousands in the event of a total loss. It’s essential to consider whether your car’s market value differs significantly from the amount left on your loan, as this is where gap coverage becomes beneficial.

| Coverage Type | Pros | Cons |

|---|---|---|

| Loan Gap Insurance | Covers the difference between loan balance and vehicle value | May be costly |

| Lease Gap Insurance | Protects against high lease balances | Not needed if leasing at low monthly payments |

| Financed Vehicle Gap Insurance | Great for new car buyers | Limited to new vehicles |

After determining your specific needs, it’s crucial to shop around for the best gap insurance policies. Start by obtaining quotes from multiple providers and make sure to read the fine print on coverage limits and exclusions. You should also consult with your financial advisor or insurance agent to clarify the terms and understand the implications of each policy thoroughly. This due diligence will enable you to make a well-informed choice.

Actionable Steps To Remember

- Assess your vehicle’s current market value vs. loan balance.

- Determine if you need gap insurance based on your financing terms.

- Compare quotes from different insurance providers.

- Read the fine print on each policy for coverage limits.

- Consult a financial advisor for tailored advice.

- Evaluate whether to purchase gap insurance upfront or through your lender.

Ultimately, knowing how to navigate the complexities of gap insurance will empower you as a consumer. By understanding the benefits and limitations, as well as the financial implications, you can make better decisions that safeguard your assets in a volatile market. Keeping these insights in mind will not only help you choose the right coverage but also enhance your overall financial literacy.

No comment